The Best Guide To Hsmb Advisory Llc

Table of Contents6 Easy Facts About Hsmb Advisory Llc ExplainedOur Hsmb Advisory Llc StatementsHsmb Advisory Llc Can Be Fun For EveryoneNot known Incorrect Statements About Hsmb Advisory Llc Hsmb Advisory Llc Can Be Fun For EveryoneHow Hsmb Advisory Llc can Save You Time, Stress, and Money.Everything about Hsmb Advisory Llc

Also realize that some plans can be expensive, and having specific health problems when you use can enhance the premiums you're asked to pay. Life Insurance St Petersburg, FL. You will certainly need to make certain that you can manage the premiums as you will certainly need to dedicate to making these payments if you want your life cover to remain in placeIf you really feel life insurance coverage can be valuable for you, our partnership with LifeSearch permits you to obtain a quote from a number of providers in dual fast time. There are various types of life insurance policy that aim to meet different security demands, including degree term, decreasing term and joint life cover.

The 7-Second Trick For Hsmb Advisory Llc

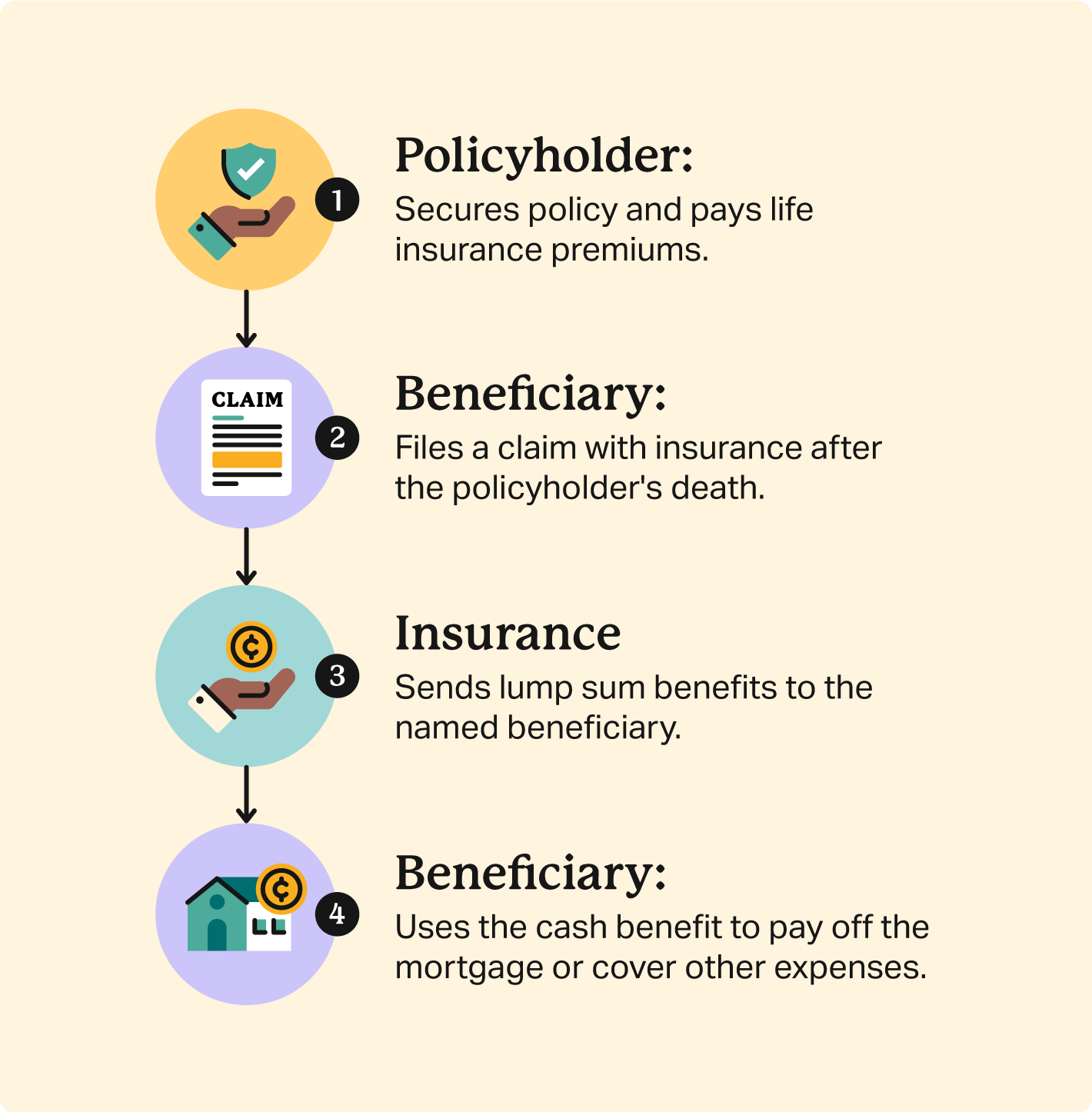

Life insurance policy gives 5 financial benefits for you and your household (Insurance Advise). The major advantage of including life insurance policy to your monetary strategy is that if you pass away, your heirs receive a round figure, tax-free payment from the plan. They can utilize this cash to pay your final expenses and to replace your revenue

Some plans pay out if you create a chronic/terminal ailment and some supply cost savings you can utilize to support your retirement. In this write-up, discover the numerous advantages of life insurance and why it might be an excellent idea to buy it. Life insurance policy uses benefits while you're still to life and when you pass away.

Not known Facts About Hsmb Advisory Llc

If you have a policy (or plans) of that dimension, individuals that rely on your income will certainly still have money to cover their recurring living costs. Beneficiaries can make use of policy advantages to cover crucial everyday expenditures like lease or home loan repayments, energy bills, and groceries. Typical annual expenses for homes in 2022 were $72,967, according to the Bureau of Labor Data.

The Basic Principles Of Hsmb Advisory Llc

In addition, the cash value of whole life insurance expands tax-deferred. As the cash money worth develops up over time, you can utilize it to cover costs, such as acquiring an automobile or making a down settlement on a home.

If you make a decision to obtain against your cash money value, the lending is exempt to revenue tax as long as the policy is not surrendered. The insurer, nonetheless, will certainly bill interest on the financing quantity until you pay it back (https://nowewyrazy.uw.edu.pl/profil/hsmbadvisory). Insurance coverage companies have varying rate of interest on these financings

The Hsmb Advisory Llc Statements

For instance, 8 out of 10 Millennials overestimated the cost of life insurance policy in a 2022 research study. In reality, the ordinary expense is more detailed to $200 a year. If you believe buying life insurance policy might be a smart economic move for you and your family members, take into consideration seeking advice from with a monetary advisor to adopt it into your economic plan.

The 5 primary types of life insurance policy are term life, whole life, universal life, variable life, and last expenditure insurance coverage, additionally known as funeral insurance coverage. Entire life begins out setting you back more, however can last your entire life if you maintain paying the costs.

Hsmb Advisory Llc Fundamentals Explained

Life read this insurance coverage might additionally cover your mortgage and supply money for your household to maintain paying their bills (https://www.callupcontact.com/b/businessprofile/HSMB_Advisory_LLC/9007265). If you have household depending on your earnings, you likely need life insurance policy to support them after you pass away.

For the most part, there are two sorts of life insurance plans - either term or permanent plans or some combination of both. Life insurance companies use numerous forms of term strategies and conventional life policies as well as "interest delicate" items which have actually come to be a lot more common given that the 1980's.

Term insurance coverage offers protection for a specified period of time. This period can be as brief as one year or supply insurance coverage for a specific variety of years such as 5, 10, two decades or to a defined age such as 80 or in some cases as much as the oldest age in the life insurance policy mortality.

8 Easy Facts About Hsmb Advisory Llc Explained

Presently term insurance prices are very affordable and among the most affordable traditionally experienced. It needs to be noted that it is an extensively held belief that term insurance coverage is the least expensive pure life insurance policy protection offered. One requires to assess the plan terms meticulously to make a decision which term life choices appropriate to fulfill your particular situations.

With each new term the costs is raised. The right to renew the policy without evidence of insurability is a crucial advantage to you. Otherwise, the danger you take is that your health might deteriorate and you may be unable to acquire a plan at the very same rates or perhaps whatsoever, leaving you and your beneficiaries without insurance coverage.